In 1972, Richard Nixon famously made a visit with Chairman Mao in China. It was seen as mildly controversial at the time, but given Nixon’s extensive record as an anti-communist nobody had great concerns that the United States was bending the knee to the commies. The phrase “Only Nixon can go to China” was born out of this. This idea that only someone with an extensive record promoting a particular cause is given leeway to do something seen as in opposition to the cause.

Fast-forward 50+ years, and President Donald Trump (a man with quite a few Nixon like-qualities) seems to be doing a pivot of his own against his traditional economic posture.

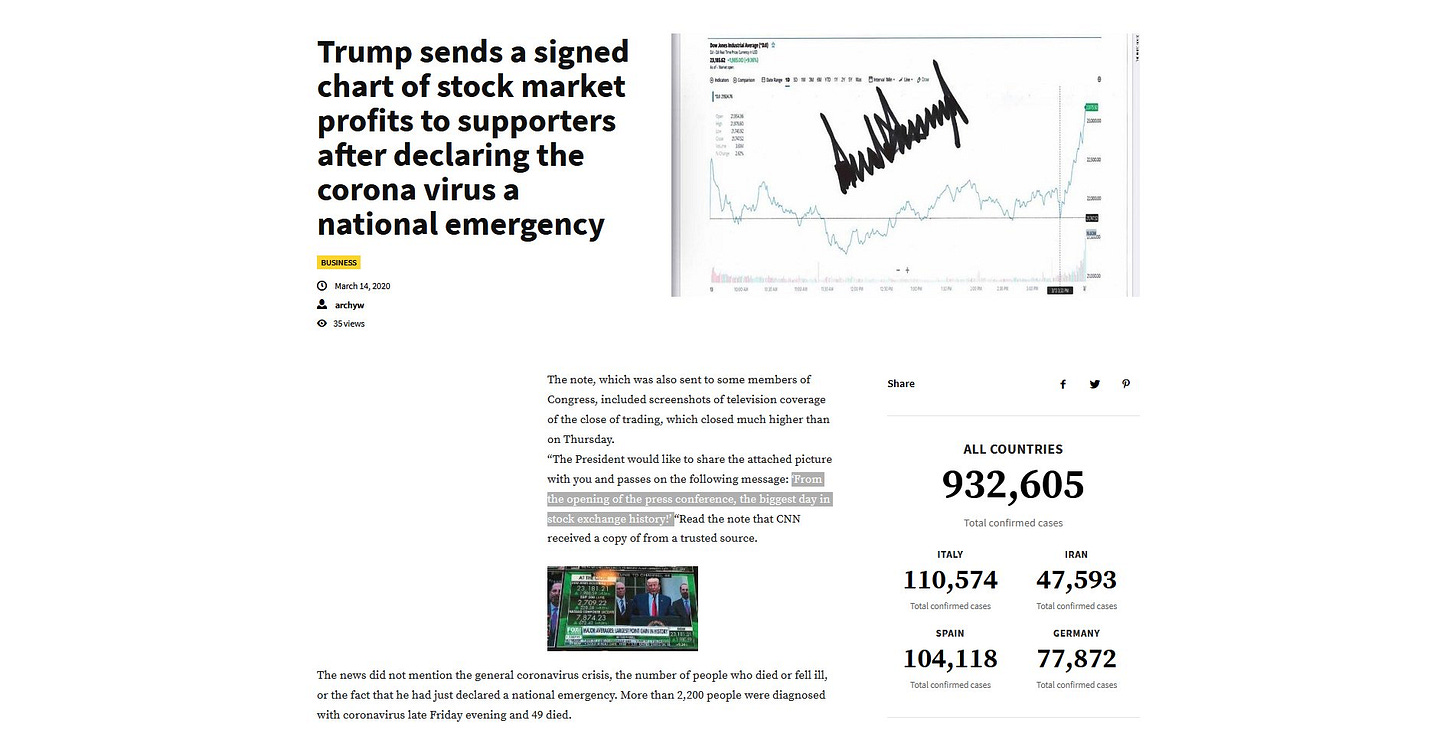

There was no greater cheerleader of the stock market than Trump 1.0. Never did The Donald pass up an opportunity to inform the people the indexes reached new highs. He referred to it as a “scoreboard” of sorts, indicating the confidence industry had in the direction he was steering the country. His greatest stroke of stock market bravado was probably during the brief COVID-era collapse. He did a speech right before the end of one day and the market rallied sharply on his comments. Satisfied with his exploits, Trump proceeded to send out signed copies of that day’s Dow Jones chart to reporters.

To put it simply, if there is a man that enjoys seeing the U.S. stock market going up it is Donald Trump.

However, Trump 2.0 has put the priority on the back-burner. Opting to play a more long-term game to sure up the American deficit and onshore more industry even if it comes at the expense of some short turn turmoil in the economy and financial markets.

Much of this was telegraphed in the run up to the election and inauguration, but it is interesting to see Trump following through with more gusto in his 2nd term. Trump 1.0 often teased about tariffs, but didn’t actually enact many serious sanctions.

Then you have the Department of Government Efficiency which seems to be doing good work on curtailing the fraud and abuse in Washington, but will certainly lead to some upheaval for those that had been feeding on the gravy train.

DOGE was fun branding (it’s a dog!) for an office who’s main business is firing people who won’t find commensurate employment elsewhere. One man’s government waste is another’s paycheck, and many of these bureaucrats will probably find the private sector values their services at a fraction of what they were originally getting paid.

Musk has even hinted that if DOGE truly realizes its goal, you’d have a bit of a controlled demolition of the economy while things transition.

Maintaining Popular Support

The greatest hurdle in addressing certain economic issues in America has always been the short-term nature of election cycles. Congress shakes up every two years, the Presidency every four. The structure incentivizes choosing quick fixes of facing the deep core issues. You just want to keep the ship afloat until the next trip to the ballot box.

In an interview last weekend (which may have spooked the markets) Trump lamented short-termism and started distancing himself from his previously beloved stock market scoreboard. Stating "You can't really watch the stock market... China thinks in 100 years, we go by quarters.”

Which is true, its difficult to execute “grand visions” when you’re always plotting for the next earnings report or election.

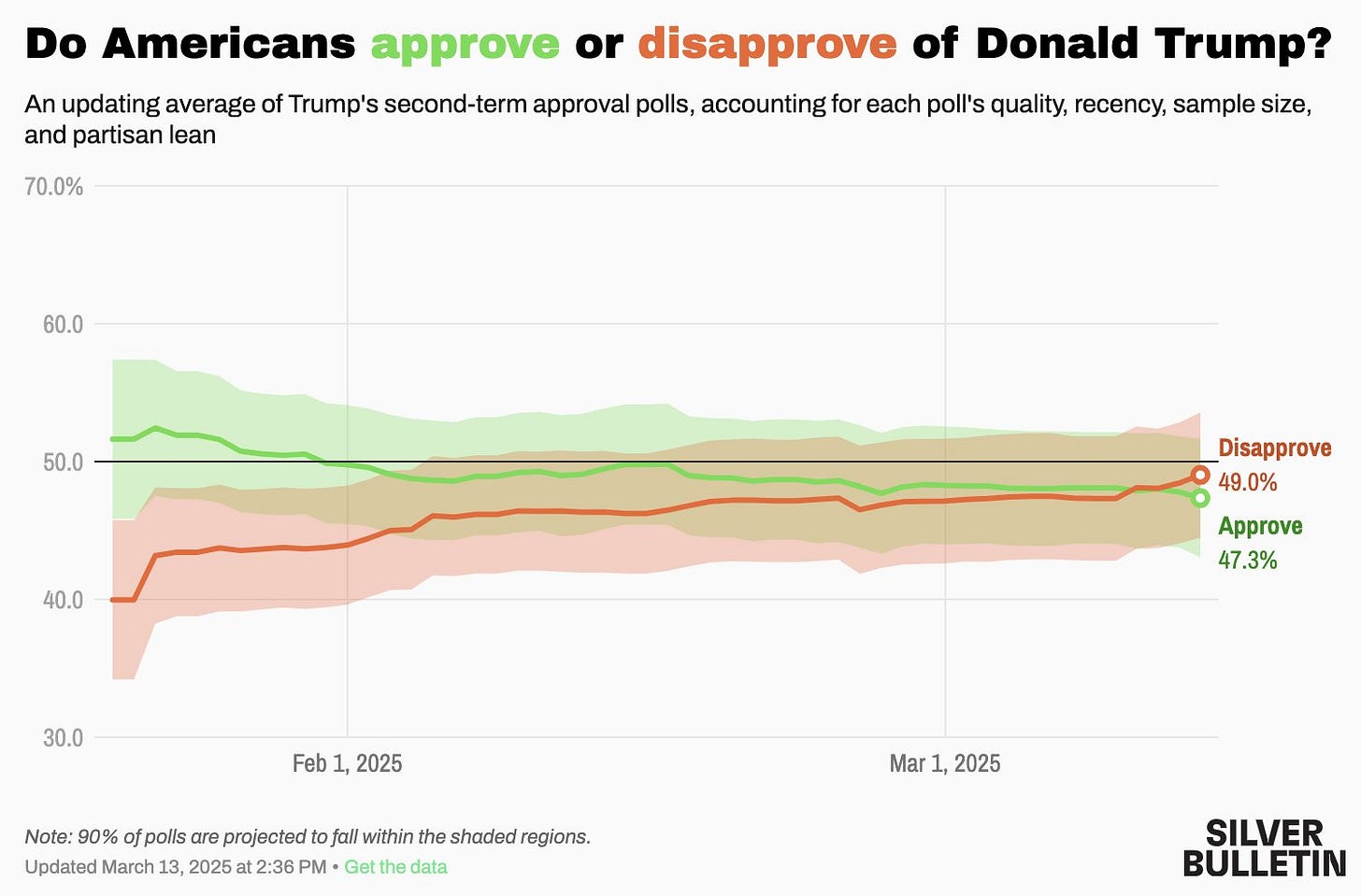

Trump, I think though, is uniquely positioned to retain support even through a potentially murky economic time. His approval rating dipped slightly this month, but but not enough to really cause alarm. Speaking with many Trump supporters, they aren’t too fazed by any sort of drawdown in their 401(k)s or economic slump. They’ve either bought into to the vision, or even if they aren’t crazy about the economic policies, they’re over the moon about what Trump is doing with the culture war and immigration stuff that they’re willing to tolerate a bit of a decline.

The core Trump base of about 35-40% of the country is so fiercely loyal to him in away we haven’t seen with many American presidents ever. If any other president hinted that they may want to do a bit of a controlled demolition of the economy to rebuild it people would be up in arms. Trump though has built his loyalty up through the years, and his credibility as a business champion, to the point where only he could be capable of “crashing the economy” and not totally losing support.

The stock market is really boomer nonsense when you think about it. Because of the fiat money system the boomers invented, it’s now impossible to save for retirement since inflation will just destroy all that value. You have to speculate on stocks or invest money into real estate you don’t need in order to “save money”. Thanks boomers!!

Young people don’t really give a shit about the stock market because they don’t have massive 401ks. All they care about is their wages, consumer goods prices and housing prices. The stock market going up or down hardly affects them.

Boomers on the other hand, even my own mother, consider a 5% decline in the stock market (or housing prices for that matter) to be exactly equivalent of someone stealing 5% of the money they have in their savings account. It’s an absolute catastrophe in their mind. This is why we get retarded Keynesian stimulus and constant bubble creation every time the market starts readjusting to a lower, more sensible level.

I wouldn't be so sure that Trump can "crash the economy" and not pay a heavy political price for it.

He's only been president for 50 days and unemployment remains low. If it starts ticking up all bets are off in terms of his popularity.

I'm really concerned about the tax cut bill that is expected to add $20T to US debt over the next 10 years. All that extra borrowing will push up interest rates which seems like the opposite effect we'd want.